The housing market is showing renewed activity, supported by recent shifts in mortgage rates. Mortgage rates have declined by nearly one percentage point this year, prompting increased buyer engagement.

Mortgage application volume has risen as borrowing costs have eased, signaling that some buyers who previously paused their searches are re-entering the market. This increase in activity suggests that sellers who list earlier may benefit from reduced competition before broader market participation resumes.

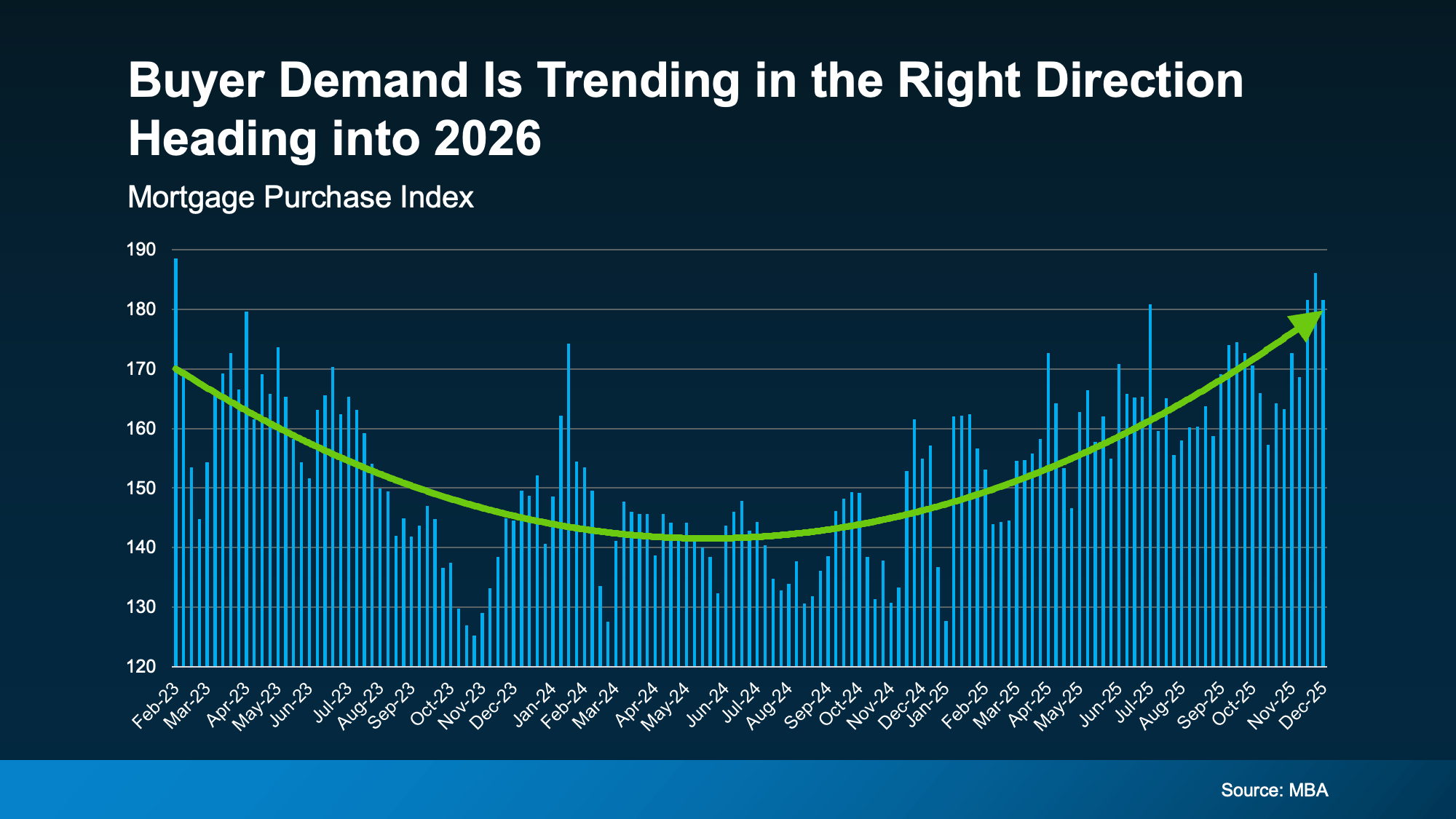

Buyer demand in today’s housing market remains highly sensitive to mortgage rate changes. When rates decline, mortgage applications tend to increase. According to Rick Sharga, Founder and CEO of CJ Patrick Company, buyer activity has consistently picked up when rates move into the low-to-mid 6% range.

Current data reflects this trend. While application volume may fluctuate alongside rate movements, overall buyer activity has improved since rates began to decline.

In fact, the Mortgage Bankers Association (MBA) shows the Mortgage Purchase Index is hovering at the highest level so far this year:

And that’s not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And that’s not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

Recent increases in buyer activity are not solely the result of pent-up demand from temporary disruptions in government loan processing earlier in the year. Data shows a steady increase in market momentum over the course of the year, indicating broader improvement rather than a short-term rebound.

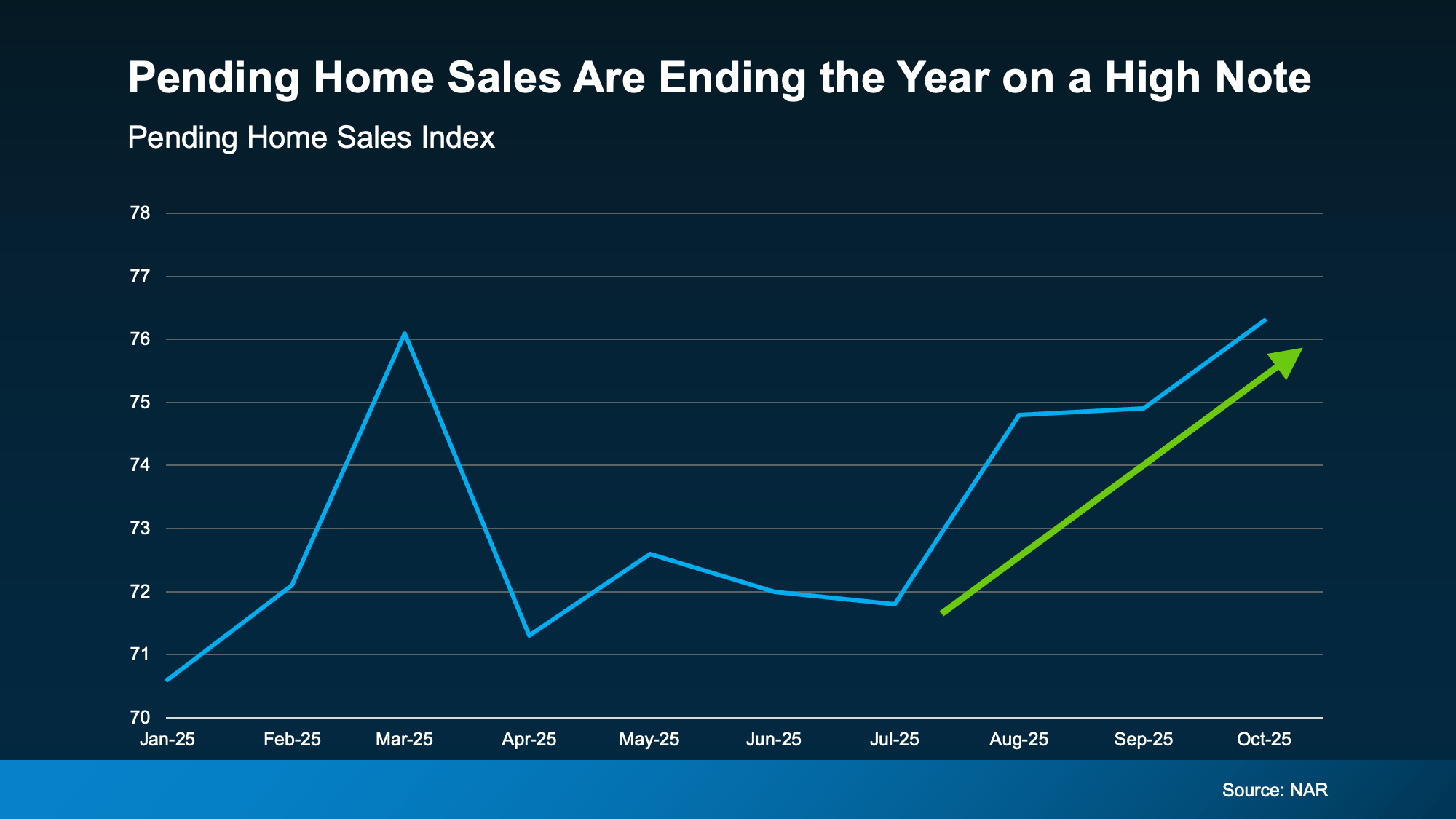

As mortgage rates have declined, buyers have gradually returned to the market, leading to an increase in signed purchase contracts. This shift reflects renewed confidence and growing demand across many local markets.

Home Sales Are Rebounding

Additional data supports this trend. According to the National Association of Realtors (NAR), pending home sales—properties currently under contract—have increased in the most recent reporting period. The Pending Home Sales Index has reached its highest level so far this year, signaling continued strengthening in buyer activity.

(see graph below):

The housing market is closing the year with increased activity and entering 2026 with renewed momentum. While the shift may appear gradual, recent trends point to a meaningful rebound.

Pending home sales are considered a leading indicator of future market performance. An increase in homes going under contract typically signals higher closed sales in the following one to two months. This trend may help explain why many industry forecasts project home sales in 2026 to be modestly higher than in 2025 and 2024.

Short-term fluctuations may occur due to seasonal volatility in mortgage rates. However, most expert forecasts anticipate rates remaining relatively stable throughout 2026, which could support continued market momentum into the new year.

Implications for Sellers

Improving affordability and increased buyer engagement may result in stronger demand, including higher showing activity for well-priced and well-presented homes. Listing earlier in the cycle may also allow sellers to benefit from rising demand before additional inventory enters the market.

For homeowners who delayed selling due to slower conditions earlier in the year, current trends suggest improving conditions heading into 2026.

Summary

Buyer activity is showing signs of recovery, and forward-looking indicators suggest continued improvement. Understanding local market conditions and timing may help sellers make informed decisions as the new year approaches.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.